What to Bring to Your Estate/Probate Consultation

If you have been named the executor of an estate, it is important to come prepared for your first meeting with an attorney. In this blog, the attorneys at King & King, will provide some tips on what you should bring with you and what to expect from the meeting. Having a clear understanding of the process will help make things go more smoothly for everyone involved. Keep scrolling to learn more about the items you should bring to your meeting with the attorney, or skip to the bottom of the page to see a nice, organized list. Contact King & King to answer any questions you may have.

Current Documents (Estate Planning)

One of the first things our estate planning attorneys will do is ask to see certain documents related to the estate. Depending on the estate and the property, assets, and debts involved, it would be helpful for you to bring some documents with you to the consultation. Make sure you bring these documents with you to the meeting:

- The original will and/or trust

- Titles to vehicles or other property

- Bank statements

- Life Insurance policies

These documents will help us determine what assets are part of the estate and how to best move forward with the process. If you do not have all of these documents, that is okay. Our estate planning lawyers can still help you. However, it is helpful to bring the documentation you do have so we can get a clear picture of the estate.

Completed Questionnaire

Prior to meeting with us, it will help expedite the process if you will review and complete our questionnaire. This helps us understand the specifics of your case. Make sure you take the time to fill out the questionnaire completely and accurately. Inaccurate or missing information can delay the process. When you come to your meeting, make sure to bring the completed questionnaire with you, as well as any other documents related to the estate (such as the will or trust). Our estate attorneys will use these items to help determine the next steps needed.

Copy of the Deed

If the estate includes real property (house, land, etc.), you will need to bring a copy of the property deed with you to your estate planning or probate meeting. If you do not have a copy of the deed, our attorneys can help you obtain one, which will help make the process much easier for you throughout the probate process.

.

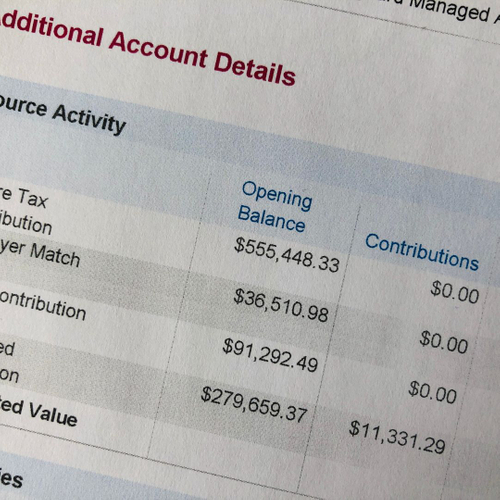

Retirement Account Statements

If the estate includes retirement accounts (IRA, 401k, etc.), you will need to provide our attorneys with statements from those accounts. These documents show how much money is in the account and will help us determine how to best distribute those assets according to the estate plan. If you do not have these statements, our attorneys can still help you, but it may take longer to properly distribute the assets.

Schedule Your Consultation Today

These are just a few of the things you should bring with you when meeting with an estate planning or probate attorney for the first time. If you need estate planning or help navigating probate court, make sure you consult with King & King. It is important to come prepared so our attorneys can better understand your estate and what needs to be done in order to move forward. If you have any questions about what you should bring to your estate planning or probate meeting, contact King & King today. We would be more than happy to help you through this process.

Want A Nice, Organized List of Items To Bring? Here You Go…

______ 1. Full legal name, date of birth, address (including county) for client.

______ 2. Death certificate if probate matter.

______ 3. Names and addresses for all beneficiaries, or heirs, including children from prior marriages, predeceased and adopted children.

______ 4. Copies of all deeds for real estate owned.

______ 5. Copy of most recent bank and/or credit union statements, which show the account number, address of bank/credit union and the style of the account. For probate matters, please include the value as of the date of death.

______ 6. Copy of the most recent brokerage account statement showing name of account, brokerage company name, address for brokerage company and account number(s). For probate matters, please include the value as of the date of death.

______ 7. Copy of the most recent IRA, 401 K Pension, or other retirement account statement showing name on account, institution holding funds, account number and address. For probate matter, please include the value as of the date of death.

______ 8. Copy of all vehicle titles, including recreational vehicles, motorcycles, motor homes and vehicles collected, boats, motors etc.

______ 9. Information on life insurance policy(s) including name of insurance, address of insurance company, policy number, name of owner, insured and beneficiary, death benefit and cash value.

______ 10. For probate matters, you should also bring the original will.

The risk of suffering a data breach has never been higher, especially for businesses in Foley, AL and Gulf Shores, AL. Small businesses are three times more likely than larger businesses to be targeted by cybercriminals. The costs of a cyberattack, both in terms of financial and reputational damage, can be devastating to small businesses. […]

You have spent years building your business in Foley, AL and Gulf Shores, AL, but at some point, the time will come for you to sell the company and exit. While many business owners choose to keep the company in the family, that is not always realistic. Family members may not have the interest or […]

Over time, your business can undergo significant changes. What may have started as a humble, one-person operation in Foley, AL can grow into a more complex company, with multiple owners, employees, an evolving mission statement, and increasing risks. As the scope and goals of your business shift, an accompanying change in business structure might be […]

Small business owners in Foley, AL and Gulf Shores, AL are no strangers to government regulations. There are many requirements that businesses must be aware of and comply with, including business license and permit rules. Most businesses must obtain licenses or permits, so it is important for each business to know which ones it needs. […]